Chamber No. 403, Western Wing, Tis Hazari Court, Delhi 110054

LLP Registration

Limited Liability Partnership (LLP) firm is popular in many countries including India. The Limited liability partnership act was enacted in 2008 to give benefits to small businesses and Startups. Incorporation and the annual compliances of LLP are lesser than a private limited company. The LLP is a body corporate and incorporated under the Limited Liability Partnership Act 2008 and is a separate legal entity from its partners, hence liability of the LLP is separate from it partners. Whereas, in a normal partnership firm, the liabilities of partners are unlimited. An LLP is a separate legal entity, so any change in partners does not affect the existence, rights and liabilities of LLP.

We at PLT CONSULTANT can help you with LLP Registration in Gurgaon, Delhi or PAN India.

Types of LLP

There are two types of LLP firms

- Indian LLP firm: The Indian LLP mean an LLP registered in India or gurgaon under the Limited Liabilities Partnership act 2008.

- Foreign LLP firm: A Foreign LLP mean an LLP registered outside India but having a place of business in India.

Benefits of LLP

These are a few illustrative lists of benefits. We have covered some of the key benefits for you:

- Separate Legal Identity: LLP is a separate legal entity and its liability and obligations are separate from its partners, So the partners of LLP have limited liability.

- Flexibility: The LLP firm is more flexible than a private limited company. The salary and remuneration to partners, interest on capital and profit distribution are subject to the written agreement signed between the partners. Hence LLP provides more flexibility by changing the clauses to the agreement as per their decision.

- Less Compaliance: In a Private Limited company there is regular compliance that needs to be completed on a monthly, quarterly, half-yearly and yearly basis, In the case of LLP, only two forms are required to be submitted annually. Hence formation and compliances of LLP become easy for the designated partners.

- Loan from Banks: LLP can raise funds from Banks and financial institutions like Bank overdrafts, Business loans, term loans, etc.

- NO Audit for Small LLP: Small LLP is not required to get its account audited if the turnover does not exceed, in any financial year, 40 lakhs rupees OR if contribution in the capital does not exceed 25 lakhs rupees.

- Image & Brand Name: The name of the LLP is in itself a brand, however, you can give a brand name to your LLP which may be different from the name of the LLP.

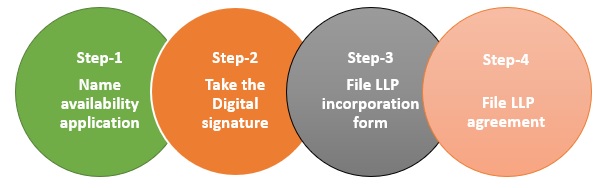

Process of LLP Registration:

Below are the explanations for the above mentioned process diagram:

Step-1: Name availability application

The first step is to apply for name availability. You can apply for 2 LLP names on a priority basis.

Step-2: Take the Digital signature of the proposed partners

The digital signature of all proposed partners is mandatory and it is affixed on the form filing at MCA.

Step-3: File LLP incorporation form

A web-based form FiLLiP is filed online for incorporation of LLP. The form FiLLiP contains the particulars of LLP, details of designated partners, other partners’ details and attachment and declaration from proposed partners. Form FiLLiP is filed along with Form 9 which is consent by the proposed partners to act as a designated partners.

Step-4: File LLP agreement

In order to submit web-based Form 3 we need to know about V3 website of MCA. The Form 3 is filed with LLP agreement’s terms and condition within 30 days of LLP registration. Non-filing of Form-3 may attract a penalty.